How to pick the right life insurance

plan? Recently, I got quite a bit of inquiry asking about life

insurance. They understand insurance is important in their financial

plans, but they are unsure where to start. so in this article, I want to

write about four simple steps that you can pick the right insurance

plan so you will never have buyer’s remorse

In Canada, there are tons of insurance

choices. First, there’s life insurance, health insurance, disability

insurance, and so much more, and when you look closer at each one,

you’ll soon find out that there are 100 different options for life

insurance

alone with so many variations to choose from. It’s hard to tell what you

really need, and there are more questions you need to answer before you

pick the right insurance.

For example, how much coverage do you

need? Should you go for a term or permanent? How can you know if the

type of insurance is good for you or how much you expect payment? All

the things to consider can make you want to just run away and not pick

any insurance, but to make your life easier, I want to share my 4 easy

filters that help you choose the right insurance.

I have my own 4C methods to choose the

right insurance plan, and it stands for Coverage, Cash flow,

Customization, and Caries. These are the four things you need to

consider when picking the right insurance, and I will explain them in

greater detail now.

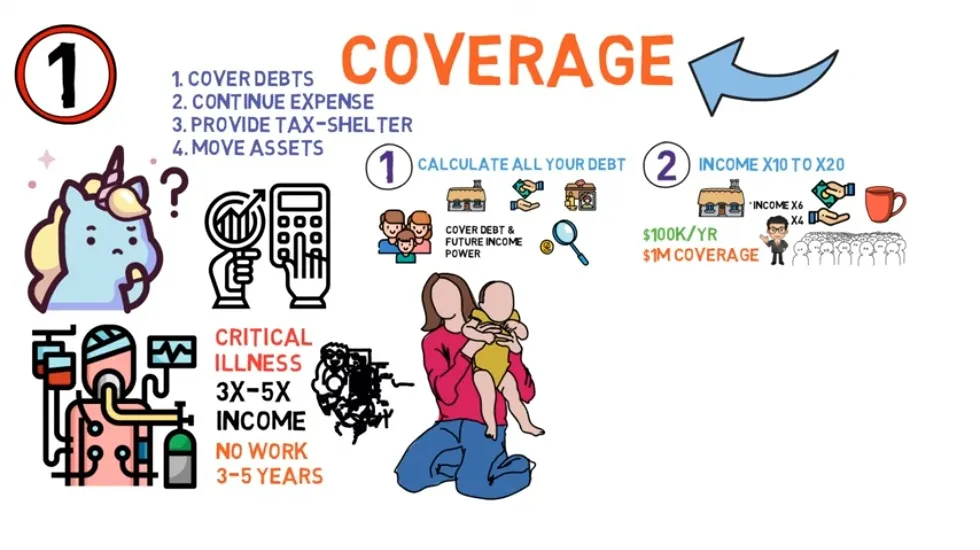

Let’s go to the first c when choosing an

insurance plan. The first question you want to ask yourself is the

purpose of this insurance.

Usually, there are four problems that insurance can help one to cover

debts. Two, to continue the existing lifestyle expense. There, to

provide additional tax shelter vehicles and four, move assets much more

efficiently.

Once we decide what problems to tackle,

we need to ask ourselves what coverage should I get then, and here’s how

I usually calculate the coverage for the insurance needs; when it comes

to life insurance, there are two ways to calculate your coverage.

One, you can calculate all your debt, such as mortgage loan and final

expense, also how much you’d like to provide for your family in case

something happens to you. The right amount of insurance should be enough

to cover the debt and the future income power this way is more

accurate, but there are lots of moving parts, so it might take a longer

time to calculate another way to calculate your needed life insurance

coverage is to take your income and times it by 10 to 20.

The reason behind it because usually,

the mortgage is six times your income already, so the remaining four

times to 10 should be able to cover the other debts. If you make a

hundred thousand dollars a year, then I will recommend at least a

million dollars of life insurance coverage, but again, just like

drinking water is recommended seven to eight glasses per day, but each

individual will be slightly different.

how about health insurance when it comes to sickness, insurance, or what we call the critical illness insurance

I usually recommend three to five times your income. The reason for that

is that you want your insurance to cover as much as possible, imagine.

For example, if you suffer from cancer or a heart attack, there is no

way to return to work soon, so you need to be financially protected for

at least 3 to 5 years without worrying about the money. Still, what if

I’m a housewife with no income? Then I’ll suggest using your husband’s

income as a reference. That’s not a word when you’re sick; your husband

needs to take time off to take care of you, so he needs a plan to

provide financial support.

For sure, we don’t hope that you get so

sick that you cannot work anymore, but that’s exactly what insurance is

for to be protected in case anything happens.

Now I also want to share how you can

calculate the coverage for disability insurance. This one is different

from life and sickness insurance, where if you buy two life insurance,

you can get double the coverage disability insurance is a direct income

replacement insurance.

The maximum you can get is usually

between 65 to 80 of your full income, so that’s a glass ceiling of how

much benefit you can receive. Once the coverage is settled, it’s time to

look at the second C, the Cashflow, which deals with the budget you

should set aside for your insurance. I always recommend using no more

than 10 of the income for all the insurance plans, but my philosophy is

always to use the 10 to cover the remaining 90 of your income and

assets, and here’s what I mean.

Let’s say company A offers you a job for

a hundred thousand, the numbers sound amazing, but they have no benefit

for you that means if you’re sick or disabled, they won’t pay you, or

if you pass away, the company will handle your debts. When you retire,

they have no pension plan for you versus company B, they could offer you

to pay you 90 000 only however they pay you when you’re sick and

disabled, they give you a pension plan when you retire, and also they

will pay your family a lump sum of money if you pass away.

Now what job you’re interested in? So

how do you compare the insurance quotes? There’s a possibility of using

websites to compare different quotes, but keep in mind that those quotes

are just a reference. This gets me to the point why I never recommend

buying insurance strictly online; some people feel drawn to buy

insurance online because it’s fast, and it seems like you can choose

exactly what you need, but what these people don’t understand is that

insurance is not a product it requires a plan. It has many moving parts

as it’s not like buying a house or a car with a set price and a set

return.

Insurance is more complicated than that,

and that’s why it’s so hard for many of us. The next c has to do with

how flexible your insurance is. I recommend looking at points: Do you

want this insurance plan to cover you temporarily or for the entire life

term insurance means that your insurance runs for a set amount of

years. For example, 30 years, your premium is very affordable; however,

once the 30 years is over, the premium

will go up more than 300 percent. Permanence is the opposite. It covers

you for the entire life, but the premium will be higher also; most of

the insurance plan is paid as you go plan as long as you pay, you get

covered. However, some plans can make limited pay, meaning you can pay

the entire permanent plan in 10, 15, or 20 years, like buying a place,

so you know exactly how much you’re paying into this plan. Also, there

are riders meaning you can add different benefits on top. For example,

there are options where you can get all your money back if there’s no

claim involved or if you’re on disability, then you don’t have to pay

the premium. There are at least 30 riders that you can choose from, and

there’s a lot to consider. this is very different from caries to

curious, and it can be a bit confusing because it’s not always

transparent, which gets us to the last C when choosing insurance

It also matters which company or carrier

you pick because different companies focus on different things; for

example, some companies focus on doing whole life insurance, and they

give a better dividend, some focus on term insurance, and some focus on

the professional markets like doctors or dentists and some focus on

family or young individuals and lastly some might focus on rejected

cases even you get declined by other insurance companies before some can

provide guaranteed acceptance which is quite unique in the market.

so when you choose any insurance plan, remember the 4C coverage

cash flow

customization and

caries

Remember, insurance is a solution, not a

product and I suggest at least talking to a professional first because

for the coverage and cash flow, you can find it out on your own, but for

customization and carrier, you need an advisor’s help.

created with

Website Builder Software .